[The shares were cancelled and went to 0.]

Date: Nov. 12, 2023

This is an insurance company that had significant underwriting loses for the last few years and there's a chance it will go bankrupt. Long story short: They wrote crappy insurance policies in 2018 and 2019 (right before COVID) and for the last few years have been paying out more in claims than they've received from their customers.

Anyone can see that this is a bad insurance company doing silly things (selling cheap out-of-the-money puts), but the risk/reward is so lopsided with this company that it would be a mistake not to put at least a little $ into the equity. If it goes bankrupt I lose the entire investment, but if it survives, I'm buying potential dollar bills for a few cents each.

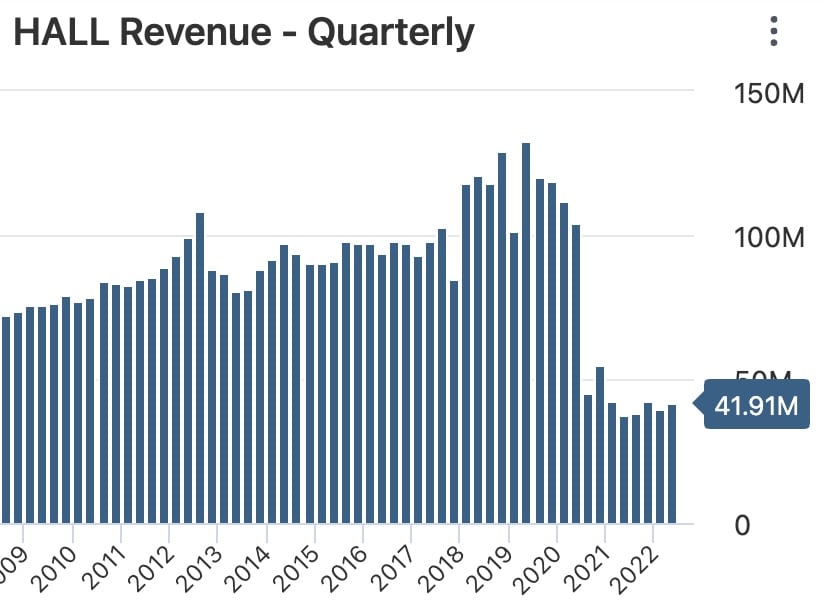

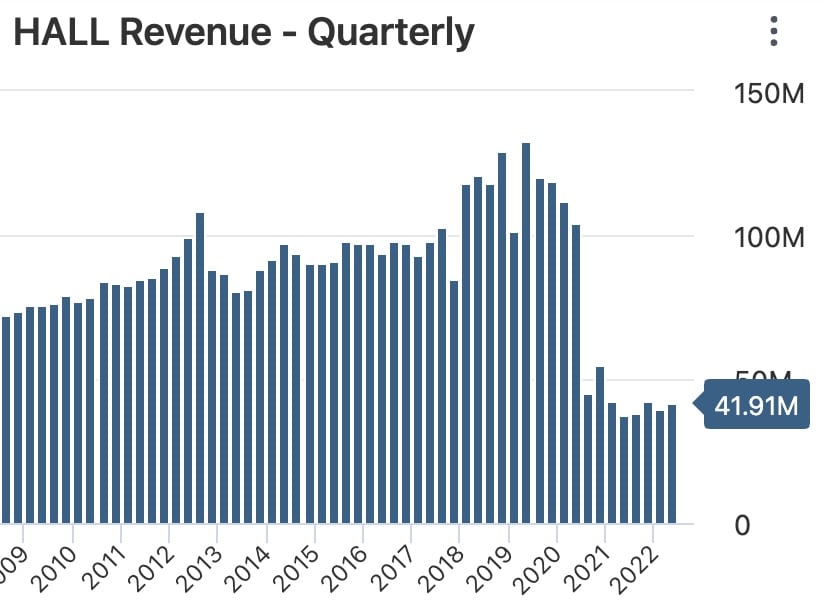

The only reason I'm even considering this company is because they seemingly stopped writing bad insurance around the end of 2020 (judging by lower revenue), and the underwriting losses will probably cease eventually (when bad policies run out). You can see in this chart that the revenue dropped significantly around the start of 2021.

If bad policies run out before the company runs out of cash (and they have an unbelievable $450M in cash as of last report against a $3M market cap), this can produce very good returns. But it is just as likely to produce a complete loss, so I would size it accordingly.