Date: Mar. 29, 2024

"...when investors feel good about an investment idea, they deem the risks low and the returns high irrespective of more objective probabilities. And when they dislike an idea, the inverse is true—risk is high and reward is low. Great investors aren't too swayed by affect." - M. J. M.

Having previously made money in DHC by buying at a low-single- percent PB (~0.06), I'm naturally quite inclined to consider similar opportunities. When looking top-down, the price-to-book ratio of OPI is 0.06.

When valuing DHC, I considered the expected returns to be extremely favourable, given that (1) forcing bankruptcy was likely not in the best interests of the lenders as somebody has to run the real estate, (2) the general consensus was that medical and senior living facilities are going to become more valuable in the future given an aging baby-boomer population and that (3) one of the executive insiders (who is also the CEO of the managing company) built a 10% stake to sway the merger of DHC with OPI favourably, ultimately failing to do so. These 3 points were top-of-mind for me, but I made allowances for bankruptcy and allocated accordingly.

When the merger didn't work out (the merger vote meeting never started and the merger was officially abandoned a few days later), OPI, the beneficiary of the merger, fell from roughly $7.33 on Sep. 1, 2023 to $3.95 on Oct 3, 2023, a month later. DHC quickly raised nearly a billion dollars in zero-coupon junk debt, pushing the maturity problem out a couple years, and thereby delaying bankruptcy, yet the stock had already jumped by then from about $0.67 to ~$3 as investors saw this coming (in other words, betting on the no-bankruptcy outcome like me). Today OPI stands at $2.04 a share, pricing the $1.3B of equity in the business at 99M.

OPI had no such good news after the cancelled merger. The office real estate market remains depressed, and all of the low-PB REITs you come across on a screener are CRE. Common narratives are: (1) remote and hybrid work is here to stay, meaning companies will choose not to renew their leases or simply fail to pay, (2) when it's time to roll over the debt, interest payments are going to become unserviceable (in many cases doubling or tripling), meaning many of these companies will have no choice but go into bankruptcy or get rid of assets in a fire sale, taking on massive write-downs and wiping the equity, (3) a possible recession in the US will lead to more of the first point, with unpaid rent contributing to poor liquidity, and finally (4) that shareholder dilution is inevitable given lack of reliable cashflows from the properties or the debt markets, meaning whatever low PB you may be buying at now will not seem so low when the company issues 100% more shares (or even more), cutting the B in your PB by half (or more).

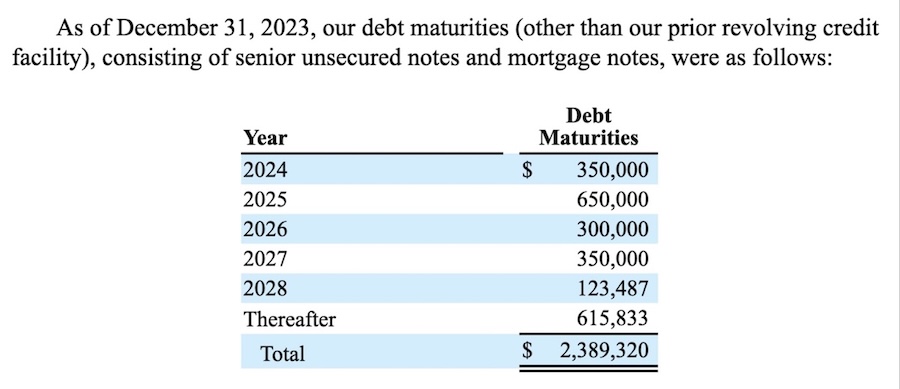

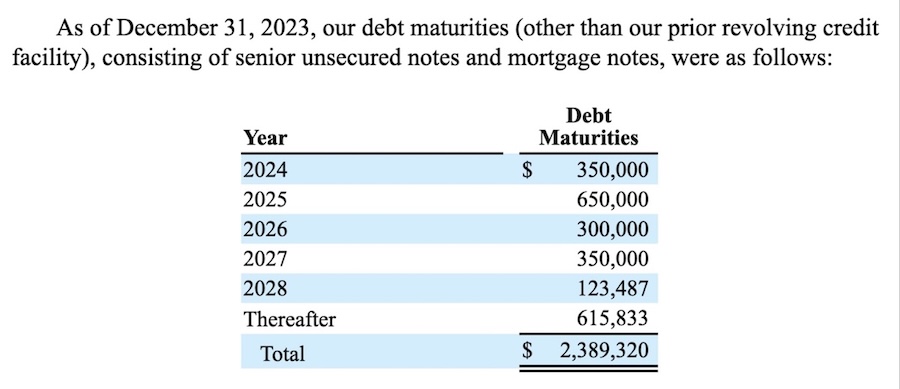

The management describes the debt maturity problem in the latest 10-K: "we currently do not have sufficient sources of liquidity to repay our $650.0 million senior unsecured notes due 2025, and while we believe it is probable that we can obtain new debt financing, we cannot be sure that we will be successful in doing so. We have engaged a financial advisor to assist in evaluating our options to address our upcoming debt maturities. There can be no assurance our advisor will be successful in assisting us with our debt maturities."

The 2024 maturities are likely safe from default: "In February 2024, we issued $300,000 of the [9%] 2029 Notes. The aggregate net proceeds from this offering were $271,500, after initial purchaser discounts and other estimated offering expenses." In addition to this, "On March 21, 2024, OPI completed the sale of an office property... to The Chicago School of Professional Psychology for $38.5 million, excluding closing costs."

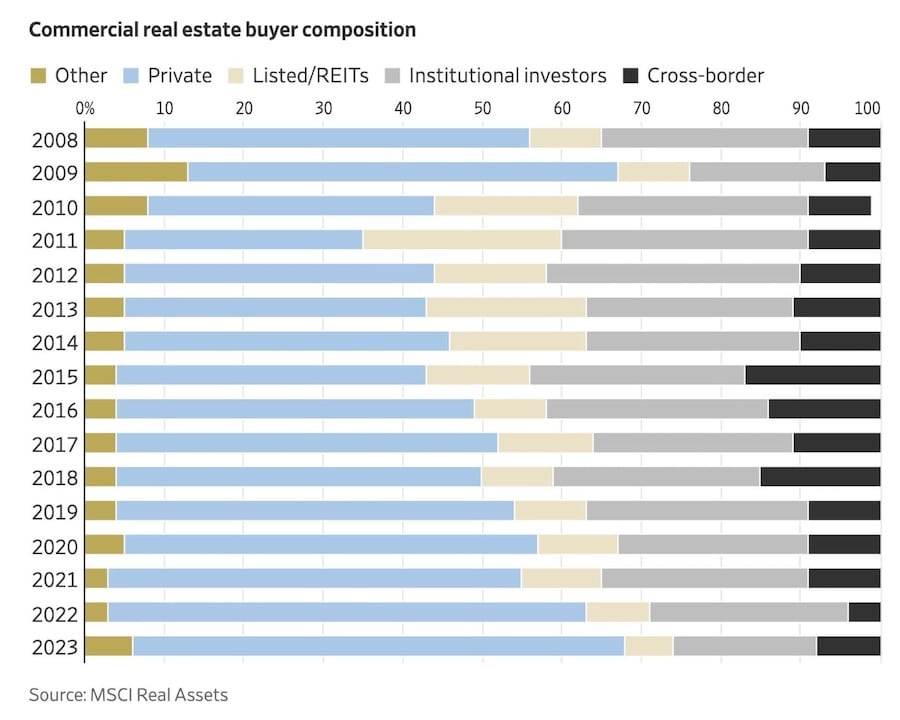

But the revolver ($205M) and the 2025 maturities (and thereafter) are obviously in trouble unless large dispositions are made. However, according to WSJ, the smart money has been buying more and more CRE, reaching proportions similar to the aftermath of the GFC:

You may notice that REITs are buying less and less, but OPI is the seller, not the buyer so this is of little relevance. Institutional investors (who are buying proportionality less and less) are typically business or career-driven folks who would scarcely risk their job to achieve contrarian outperformance, so if the markets are pricing OPI at 0.06 PB, despite fairly strong cashflows and a large chunk of rent coming from a government agency, it must be a bad investment. Private investors are of course, looking to do exactly the opposite, seeking favourable bets without worrying about how contrarian they appear.

Going back to the quote I opened with, I personally "feel bad" about OPI as an investment idea given that (1) it was actually a drag on my DHC investment given the uncertainty around the merger and (2) that I've experienced first-hand a company deciding not to renew a lease given that remote work is sufficient. Additionally, I'm usually skeptical about companies with little insider ownership and am fully aware that massive dilution or unexpected bankruptcy could take place any day (the CEO and CFO resign, key sales fall through, no insider ownership means nobody really cares, executives move on to new jobs).

Previous experiences and emotions can easily fool you. OPI being a drag on DHC's stock price was in the past, and the price has fallen by a further 50% after the merger was cancelled (which was, apparently, already priced into DHC). If one wishes to value OPI, one must do it bottom-up, not as a follow-up to the DHC idea. Lack of insider ownership at OPI is obviously a concern, but the manager, RMR Group, scarcely wants one of its clients to declare bankruptcy (unless absolutely inevitable) as it will hurt their brand and lower their $41B AUM by $4B (10%). Most managers don't like lowering their AUM.

It is possible that the REITs managed by RMR with either fail in unison over the coming years or make sales at a discount to stated book value, cutting into the equity. Yet it may be the case that markets are already pricing this in. Will the "smart money" reach for OPI's quantitatively cheap assets in private transactions? Will they be the shrewd buyers who patiently wait for a fire sale or bankruptcy proceedings, or will they be ready to buy now at slightly-less-than-market prices? I can't be sure. But what I can reliably say is that some of the people selling OPI common stock are rushing for the exits, given that the debt maturities appear unserviceable to a casual reader of the 10-K:

It is clear that SeekingAlpha commenters dislike the idea of investing in OPI equity, and so no matter how low the price goes, they will nod and say, yes this is correct. But what if, even with bankruptcy inevitable, you could buy OPI for $0.25 a share? That would be an absolute bargain given that there is some possibility of a non-bankruptcy outcome by managing or negotiating with lenders. Ironically, I think it's unlikely that any of these people would jump in at $0.25 or even at $0.01 a share. People just hate equity stubs, despite their potential for good returns, since a basket of them virtually guarantees some small losses.

I think allocating a small amount to OPI could be a high-risk, high-reward move. While there's a significant chance of default and total loss, there's also a possibility that the private market might step in and buy up some of OPI's distressed properties at reasonable prices. If that happens, the revolving credit could be serviced, the debt paid off or extended, and the stock might surge closer to $7—where it hovered for much of 2023, after the negative news about CRE were well-known, but I truly have no idea what the price will do. Long-term, the outlook for this business is unpredictable, but properties will always have value. The key question is whether that value can be unlocked quickly enough to roll over the debt.