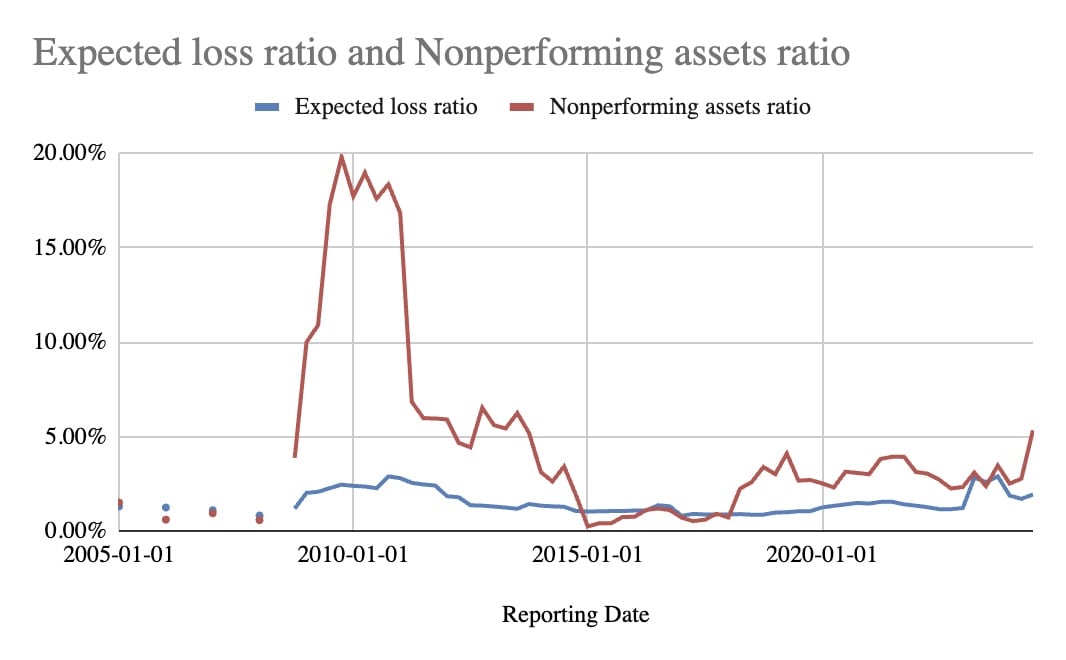

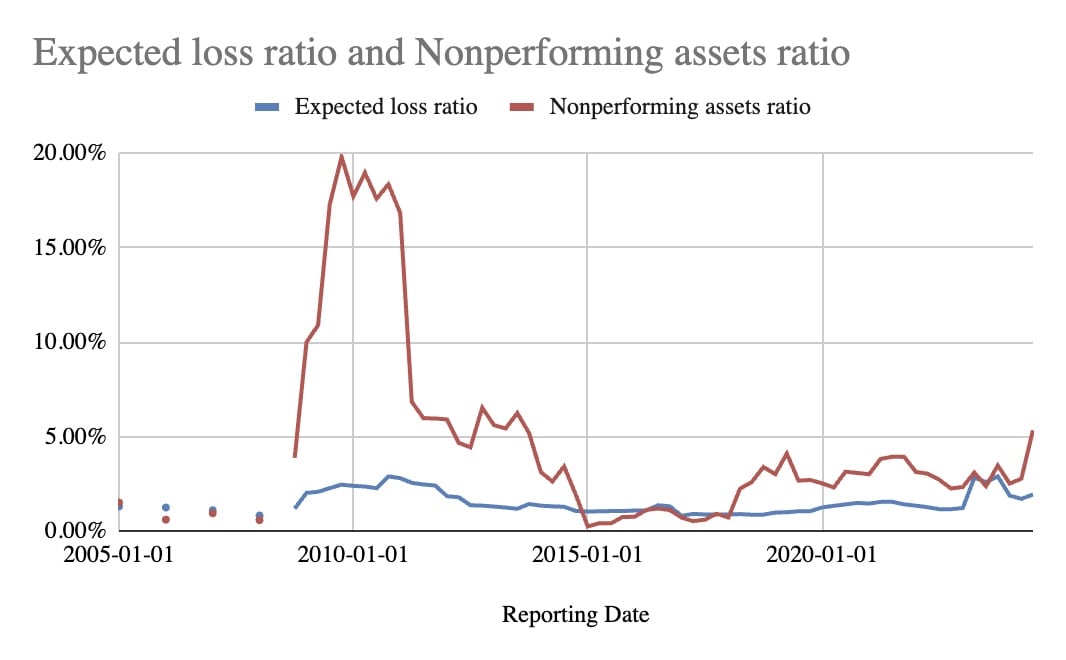

- Expected loss ratio = Allowance for credit losses ÷ Gross loans receivable

- Nonperforming assets ratio = Total nonperforming assets ÷ Gross loans receivable (using NPA instead of NPL for simplicity/conservatism)

Date: Aug. 29, 2024

Patriot National Bancorp is the holding company of a small Connecticut bank with 11 branches that barely made it through the GFC. Despite some rough earnings since then, it's still standing. In 2022, PNBK's planned acquisition by fintech startup American Challenger fell through, reportedly due to regulatory delays. The idea was for American Challenger to merge into PNBK and use PNBK's existing customer base to roll out new digital banking products.

Thanks to sizeable changes in loss provision due to the adoption of CECL in early 2023 (wiping $13M of equity), and quickly increasing nonperforming CRE loans (5% of CRE loans were nonperforming as of the last 10-Q), the company is now priced for a doomsday scenario. As of today, the bank trades at 0.16 PB, which means one of two things must happen at some point in the future:

The stock is extremely illiquid (0.2% of float trades per day on average) and the market cap is a measly $7M. Due to the small size, delisting could occur which is a real market risk for some investors.

I have a feeling that I may be missing something important here. The increasing nonperforming loans might be a sign of bigger problems ahead, or maybe this bank has no idea how to set loss reserves while the market does. However, this seems unlikely. Why would the market know better than the bank? If the market knows better than management and so values the equity at $7M, why not value it at $3M or $1M? It was surprising to find out that there is virtually no short interest on this stock.

The CFO (J.P.) runs a locksmithing company and owns virtually no shares, which makes me think he has little incentive to make the accountants manipulate earnings (not to mention his strong disincentive to preside over material misstatements). The earnings aren't great, and the bank is nowhere near recovering the losses from the GFC. They also recently laid off 20% of staff. Yet no other bank trades at such a steep discount to stated book value (the next lowest PB in the industry is 0.34—more than double).

Psychological factors make me bullish on the stock. The CECL adoption should be somewhat viewed retroactively, so the positive trend in loss reserves is less strong than it seems (the more concerning trend is the rise in nonperforming CRE loans). If accounting is done truthfully, reserves should never trend—they should be fully written down at once (D.E. writes about this in Fooling Some of the People All of the Time). Either management has the correct valuation on loans, or the market does. With the current valuation, both can't be right at once.

With $70M in Bank Term Funding Program debt due and no updates from management (loan was taken out July 2023 and must be repaid within 1 year), investors may worry that the bank has defaulted on the debt but hasn't announced it yet. I think this is highly unlikely. But even so, in my view, the Fed forcing this tiny community bank to default on a tiny loan would undermine the program's purpose, which is to shore up confidence. Think of the optics if a government program led to a default at a "Patriot Bank". I feel it's more prudent to just trust the bank to work out this loan as it comes due and expect prompt communication if something went awry.

And if the market thought there was accounting shenanigans, the stock would be heavily shorted. As I mentioned above, there is virtually no short interest. So if the market values the equity at 0.16 PB, implying that stated book value is drastically overstated (in effect establishing its own "better judgement" loss reserve) yet shows no past or current intention to short the stock, the market is being irrational. I think what's happening here is liquidity risk and forced selling of one kind or another leading to a temporary devaluation. Even if terrible losses come to pass, it's really unlikely this company is not worth closer to book.

One could shut this idea down from the earnings perspective, i.e., what is this bank really worth if it makes no money? Well, certainly more than 0.16 PB, because loans have value, even purportedly bad loans. For what it's worth, the bank claims to have no involvement with subprime loans. And on the flip side, if things are badly misstated, and the market knows, then the bank is worth zero. But if so, then where is the short interest? In my view, at current prices, you are buying a very cheap option on the bank surviving the downturn in the CRE market, if you can stomach the uncertainty around the Fed loan situation and the rise is nonperforming loans.